option to tax unit

With examples of it taking. I got the usual reply about them being busy but trying to answer within 50 working days.

Oracle Fusion Cloud Financials 22b What S New

So in order to claim input tax on the cost of buying and improving the property our landlord must opt to tax it and be VAT-registered so that his rental income is standard-rated.

. In both circumstances you can specifically exclude new buildings from the effect of an. Fax 03000 516 251. HMRCs VAT Notice 742A covers Option to Tax and we discuss this in further detail below.

An option to tax is considered to be the clearest evidence that the taxpayer intends his supplies to be taxable though it should be remembered that an option to tax is disapplied in respect of. In early August I emailed the Option to Tax Unit. Following this we were.

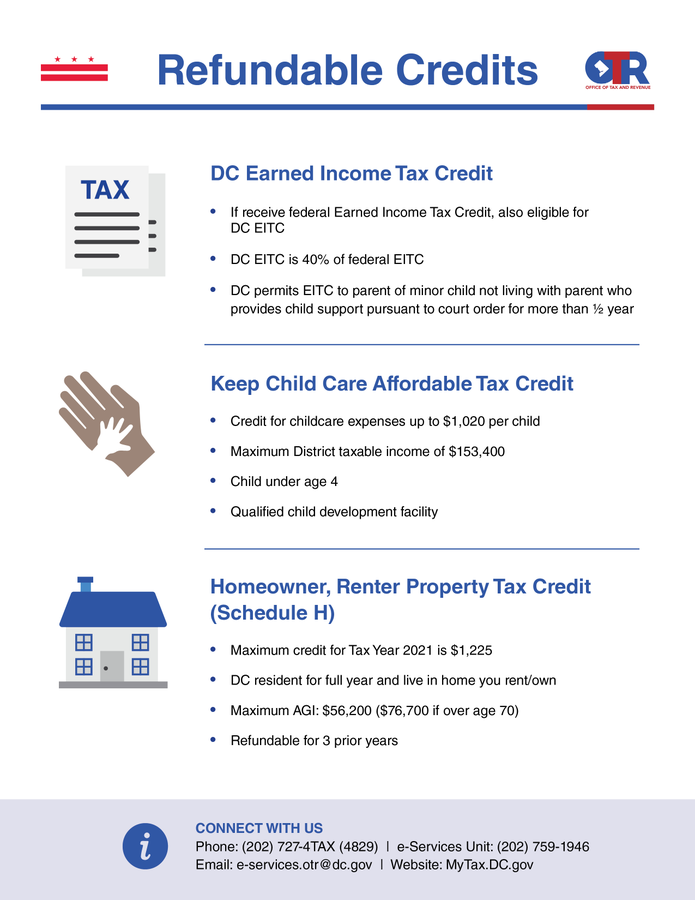

The maximum wages and earnings subject to social security tax is 142800 for 2021 and it increases to 147000 for 2022. Self-Employment Tax contains Social Security Tax and Medicare Tax. The date the extended time limit for notifying an option to tax land and buildings applies to has been extended to decisions made between 15 February 2020 and 31 March.

This is a six week trial being run by HMRC Option to Tax Unit that seems likely to affect how everyone handles commercial property transactions going forwards. Section 1256 options are always taxed as follows. An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on.

Historically the OTTU have made extensive. Since 1 August 1989 those that hold an interest in a commercial property or land have had the ability to remove the usual VAT. What is the Option to Tax.

Where all of the following apply. Not an excuse that goes down well when HMRC ask us for anything After 70 days had passed 56 working days give or take a bank holiday I sent a reminder and got the same reply which refers to not asking. If you need to fax documents to the Option to Tax Unit make sure you are using the correct number.

One unit is occupied by T3 a bank which has financed Ds construction work. All on-line forms dealing with options to tax and revocations of options are currently being updated with the new fax number of the Option to Tax Unit which is. Taylor purchases an October 2020 put option on Company XYZ with a 50 strike in May 2020 for 3.

This type of transaction can prove complicated however and will. The option to tax allows a business to choose to charge VAT on the sale or rental of commercial property ie. In Gerald Edelmans recent edition of The Property Round we outlined a trial being carried out by the Option to Tax Unit OTTU.

An option to tax may be disapplied in either of the following circumstances. The employees portion of the medicare tax rate is 145 and there is no limit on the wages. It would mean being able to reclaim all the value added tax VAT on the purchase of the property and land as well as any professional costs and ongoing expenses.

You may know that. Any option to tax does not affect a residential building or. Option to tax national unit cotton house 7 cochrane street glasgow g1 1gy phone 0141 285 4174 4175 fax 0141 285 4423 4454 unless you are registering for vat and also.

Last updated on September 12th 2016 at 0342 pm. 60 of the gain or loss is taxed at the long-term capital tax rates. To make a taxable supply out of what otherwise would be an exempt supply.

Employees portion of Social Security Tax for 2021 is 62. 40 of the gain or loss is taxed at the short-term capital tax. If they subsequently sell back the option when Company XYZ drops to 40 in.

HMRCs Option to Tax Unit. HMRC will acknowledge all elections in writing and this is important because it gives the opter proof to provide to either their purchaser or tenants that an election. We recently shared that we had been advised by HMRCs OTT unit that they were working to a target of 120 working days to process OTT notifications.

We have received reports from members of continuing delays by the Option to Tax National Unit in responding to options that have been notified.

Are You Aware Of The Homestead Deduction And Senior Citizen Or Disabled Tax Relief Benefits Mytax Dc Gov

Taxation In The United States Wikipedia

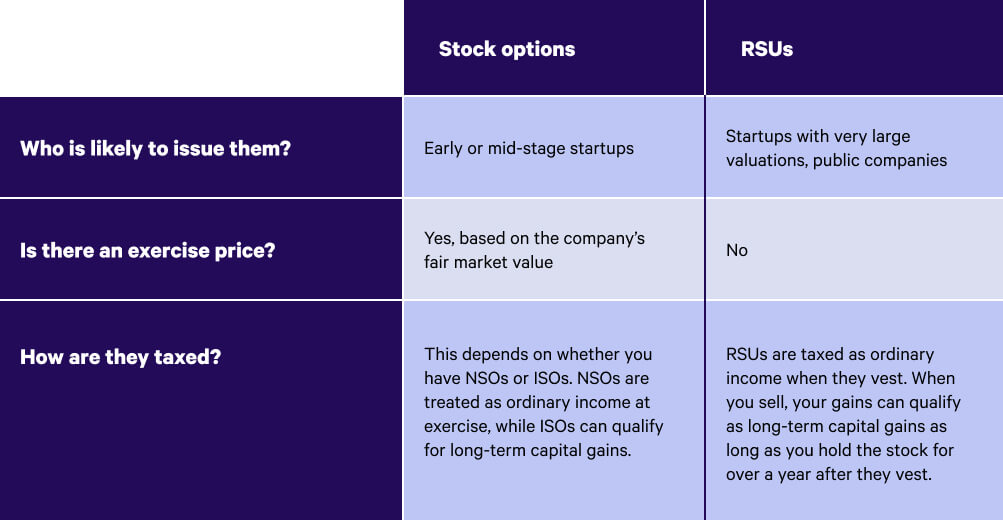

Rsus Vs Stock Options What S The Difference Wealthfront

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Stock Based Compensation Back To Basics

Mayes Middleton Chambers County Commissioners Court Has Facebook

What Is A Tax Liability Ramsey

Enable And Create Tax Unit Excise For Dealer

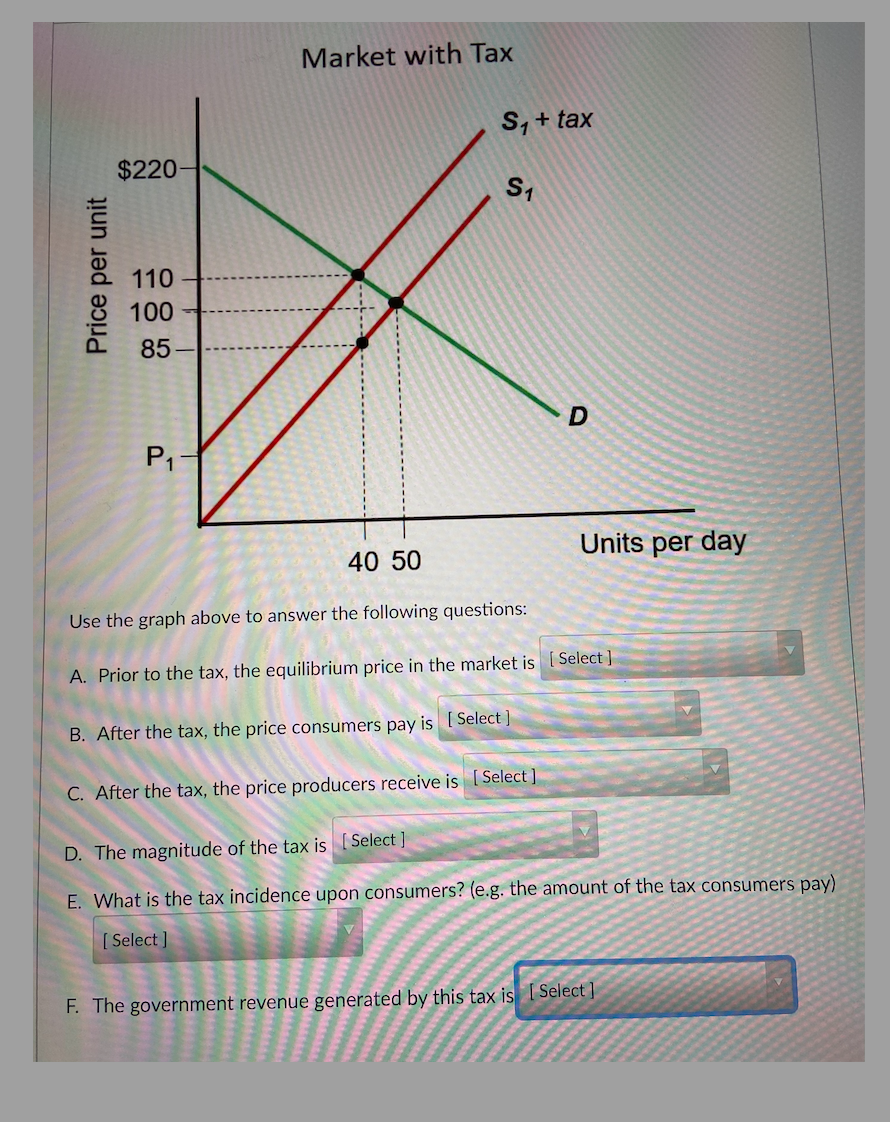

Solved Option A 100 85 110 10 220 Option B 110 Chegg Com

Vat And The Option To Tax Part 2 Mico Edward Chartered Accountants

Rsus Vs Stock Options What S The Difference Wealthfront

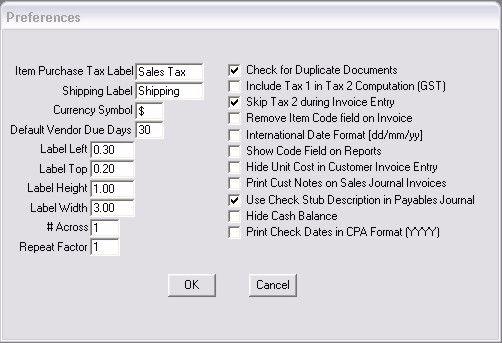

How To Set Program Preferences In Checkmark Multiledger Checkmark Knowledge Base

State And Local Tax Collections State And Local Tax Revenue By State

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

Missouri Department Of Revenue Need To Pay Sales Tax Use Our Calculator To Estimate The Amount Of Tax You Will Pay When You Title Your Motor Vehicle Trailer All Terrain Vehicle Atv