nebraska tax withholding calculator

Find your income exemptions. There are four tax brackets in.

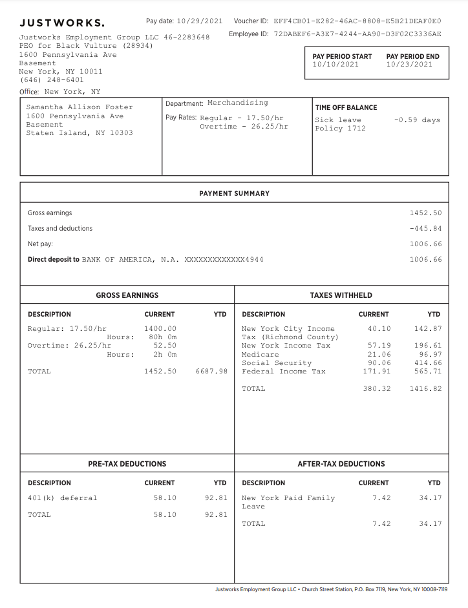

Hourly Paycheck Calculator Business Org

2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories.

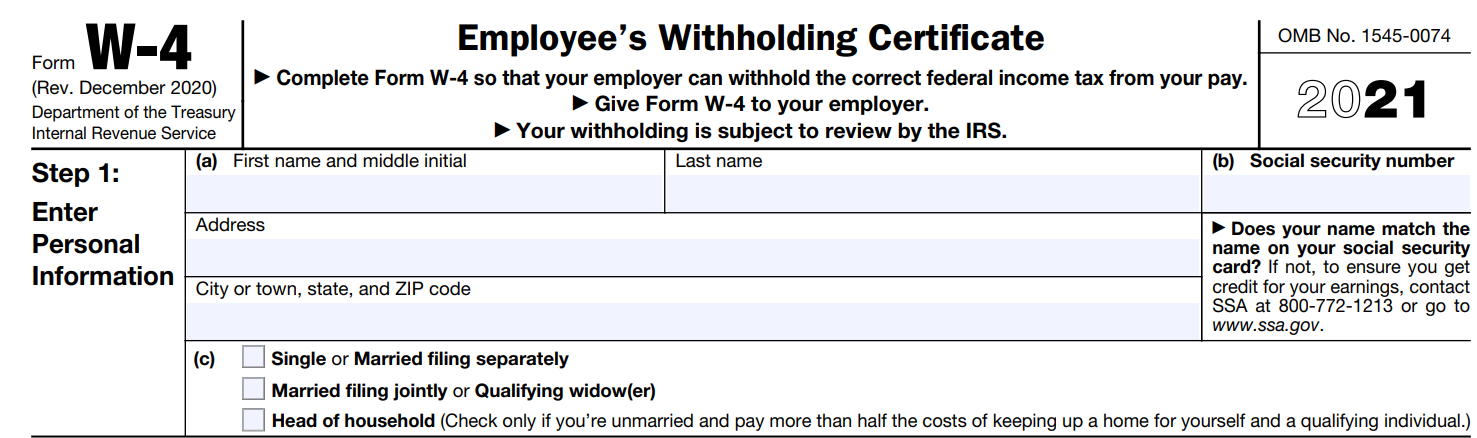

. The State of Nebraska has introduced a State Form W-4N to claim marital status and exemptions for State withholding purposes effective January 1 2020. Find your pretax deductions including 401K flexible account. The Federal or IRS Taxes Are Listed.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. The income tax withholdings for the State of. March 7 2022 Effective.

The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in a given calendar year. Usually you can calculate Nebraska payroll income tax withholdings in the following ways.

Its a progressive system which means that taxpayers who earn more pay higher taxes. The Nebraska Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. 00601 An employer must deduct and withhold Nebraska income tax from all wages paid to an employee who is a nonresident of Nebraska for services performed in Nebraska.

W-4 Form Basic -. Nebraskas state income tax system is similar to the federal system. Calculate your Nebraska net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Nebraska.

Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax. Tax Calculators Tools. The Nebraska income tax.

The Nebraska Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022. Form W-4 Tax Withholding. You must also match this tax.

Payroll check calculator is updated for payroll year 2022 and new W4. Pay Period 04 2022. The NE Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NES.

It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount. Calculate Nebraska state tax manually by using the state tax tables Use payroll software to. Today Nebraskas income tax rates range.

How to Calculate 2022 Nebraska State Income Tax by Using State Income Tax Table. The Nebraska Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Nebraska State. 100 rows In 2012 Nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable.

TAXES 22-08 Nebraska State Income Tax Withholding.

Nebraska Child Support 15 Key Elements Of Child Support In Nebraska

Tax Calculator Return Refund Estimator 2022 2023 H R Block

/cloudfront-us-east-1.images.arcpublishing.com/gray/SOFL3NEDPBOIXKWVX3I5NYJBSM.jpg)

Lincoln City Council Passes 13 Percent Budget Increase

State W 4 Form Detailed Withholding Forms By State Chart

Nebraska Paycheck Calculator Tax Year 2022

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

Irs Issues New Federal Payroll Tax Withholding Tables Nebraska Today University Of Nebraska Lincoln

New York Hourly Paycheck Calculator Gusto

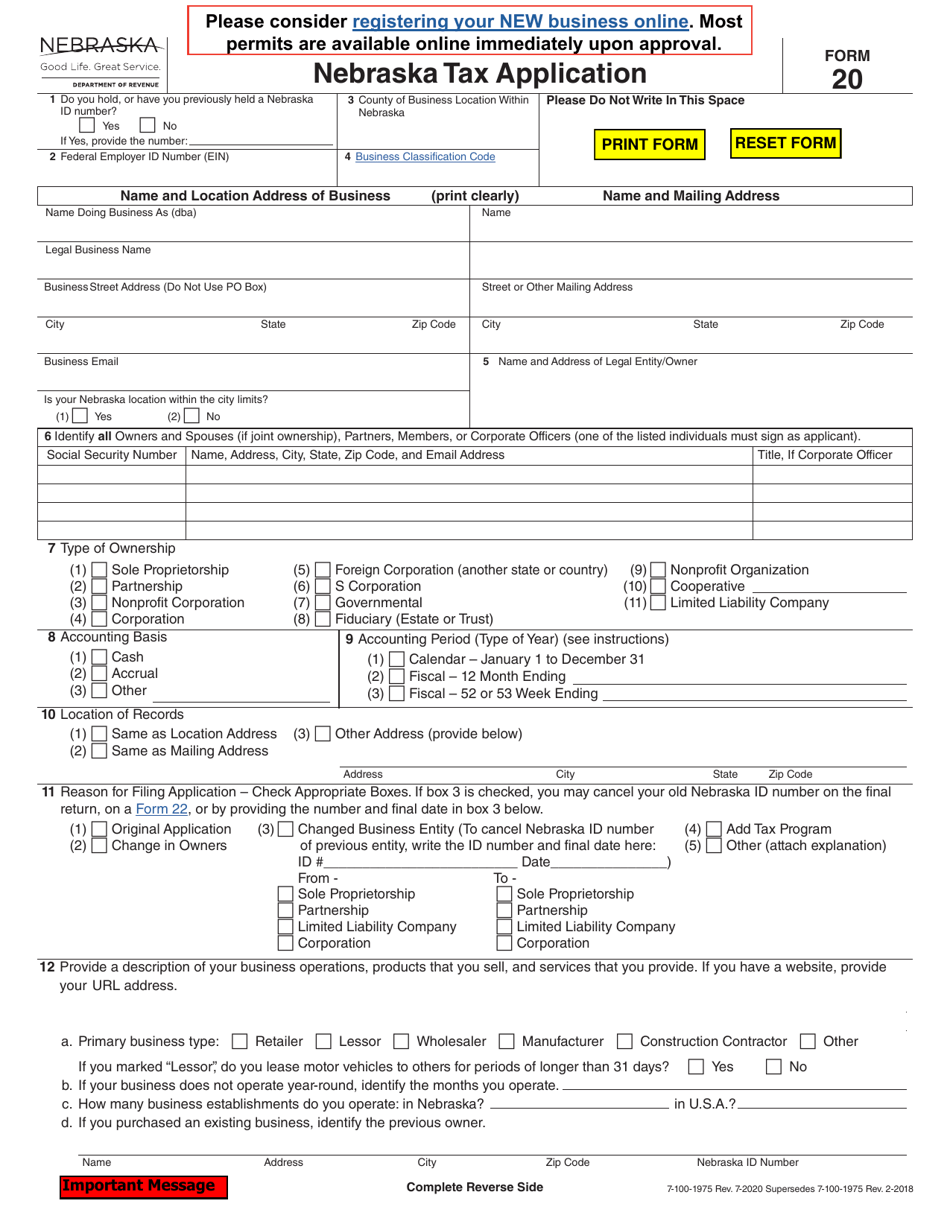

How To Apply For A Tax Id In Nebraska

New Irs Withholding Calculator Released Cornell Chronicle

Tax Withholding For Pensions And Social Security Sensible Money

Questions About My Paycheck Justworks Help Center

Social Security Benefits Tax Calculator

W 4 State Withholding Tax Calculation 2020 Based On The State Or State Equivalent Withholding Certificate Sap Blogs

How To Calculate Nebraska Income Tax Withholdings

Payroll Tax Calculator For Employers Gusto